In brief

- Crypto-based prediction market Polymarket was a breakout success in 2024.

- The platform accurately predicted global events throughout the year, including the U.S. presidential election.

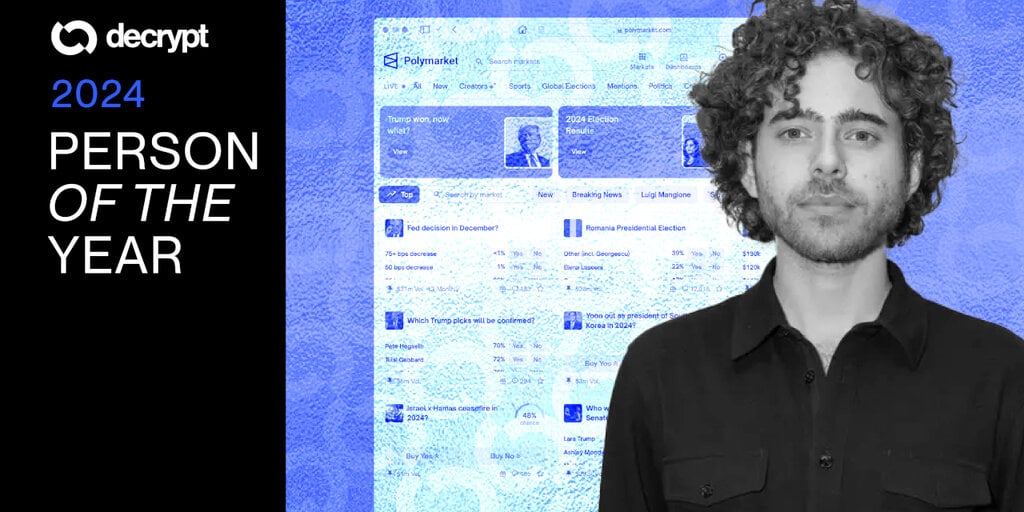

- Its 26-year-old CEO Shayne Coplan, who views the world through the lens of probabilities, is Decrypt’s 2024 Person of the Year.

Four years ago, he was just another callow entrepreneur, hacking away in a makeshift bathroom office at his passion project—a prediction market that would blend gambling with real world events. This year that project, Polymarket, emerged as one of the most interesting and potentially valuable use cases in the burgeoning crypto industry.

Shayne Coplan’s blockchain-based prediction platform captivated bettors and spectators alike this year. With each twist and turn in the 2024 U.S. presidential race, it attracted legions of new eyeballs and users, who ultimately foresaw key events like President Joe Biden’s withdrawal from the Democratic ticket and Donald Trump’s White House victory.

For Coplan, a 26-year-old New York native, navigating Polymarket’s rise into the mainstream wasn’t always easy. Even today, despite its enormous success, allegations of wash trading and market manipulation dog the platform, and a recent FBI raid of his apartment, in which his phone and computer were confiscated, have yet to be resolved.

Still, as Coplan told Decrypt, “it’s too easy to get lost in the sauce. Through all the chaos, the only way to navigate is to stay centered and pragmatic.”

While crypto entered the political realm in unprecedented ways this year, through political spending efforts and promises made by the President-elect, Polymarket’s place in that dynamic was unique. The platform attracted notable attention from outside the crypto space as a disruptive data source, showcasing this year’s political drama in real-time, despite the critics.

Speculation and crypto go hand-in-hand, but Polymarket distilled those forces into a tool that offered the world genuine insight. It gave crypto, long in search of a use case beyond Bitcoin’s store of value, the potential to attract the masses. And though it’s not a Main Street application yet, with a pro-crypto Administration about to take office in the U.S., Coplan’s startup appears well positioned to be the frontrunner among crypto startups. For these reasons, Coplan is Decrypt’s 2024 Person of the Year.

Who is Shayne Coplan?

Coplan founded Polymarket in 2020, but his passion for crypto developed long before that. Growing up on Manhattan’s Upper West Side, he said he first became interested in crypto at the age of 14, drawn to the multi-trillion industry while it was in its infancy.

2020, running out of money, solo founder, HQ in my makeshift bathroom office. little did I know Polymarket was going to change the world. pic.twitter.com/TktiCXQgXr

— Shayne Coplan 🦅 (@shayne_coplan) November 6, 2024

At 16, he participated in Ethereum’s presale, purchasing the second-largest cryptocurrency by market capitalization for around $0.30. He was then a student at The Beacon School, a highly selective high school in New York’s Hell’s Kitchen neighborhood.

Coplan was always interested in seeing the world through the lens of probabilities. At Messari’s crypto conference this year, for example, he described an interest in data-driven websites such as 538 as foundational in building that worldview.

“I was always seeking out where I could see percentage likelihood,” Coplan recalled. “A lot of the time I saw that on weird, barebones 1999 html websites that were using some sort of model that was just some guy’s thing. But the fact that you could look at the probabilities was cool.”

While Coplan would later enroll at New York University to study computer science, the entrepreneur left after only one semester. He put his studies indefinitely on pause to pursue prediction markets, hammering out Polymarket’s design during the COVID-19 pandemic.

Though Coplan left the academic world behind to pursue his dreams, he’s no stranger to how it operates. Coplan said his mother is an NYU professor, while his father teaches at another university in New York City.

In 2020, Polymarket raised $4 million in a seed round led by Polychain Capital, according to Cryptorank. This year, it raised another $70 million across Series A and Series B funding rounds, including investments from Ethereum co-founder Vitalik Buterin and Peter Thiel’s Founders Fund.

Most ideas don’t instantly become overnight successes. You only lose when you give up.

As expected, with the U.S. post-election frenzy dying down, Polymarket’s betting activity dropped, but it still appears to be holding its own. Polymarket’s daily trading volume, for example, has averaged around $50 million in December, down from its November peak of more than $85 million, but substantial nevertheless.

The number of monthly active traders peaked at 293,705 in November and dropped to 116,370 for December so far.

Betting on political events may be Polymarket’s bread-and-butter, but the platform hosts over 500 markets that ponder everything from existential questions, such as whether a nuclear weapon will be detonated in 2024, to parsing Taylor Swift’s love life.

The road to relevance

Though Polymarket has become a go-to prediction market across the globe, the platform’s success wasn’t immediate. In its first three years, that key stat of monthly active users never climbed past approximately 5,700, according to the Dune dashboard.

In April 2024, the platform was doing a scant $38 million in monthly volume. By the beginning of September, monthly volume had exploded to more than $500 million.

“Most ideas don’t instantly become overnight successes,” Coplan said. “You only lose when you give up.”

Needless to say, Coplan stuck with it, and created an innovative framework for betting on virtually anything. Notably, the platform currently charges users no fees and appears to be foregoing revenue in a bid to dominate the global market for prediction markets.

People participate in Polymarket’s contests by purchasing shares, which fluctuate between $0.00 and $1 depending on what market participants see as most likely. For example, shares priced at $0.66 would indicate a 66% chance of an event happening. (For a detailed breakdown, check out Decrypt’s guide for how prediction markets like Polymarket work.)

The run up to the U.S. general election proved to be the best possible marketing for Coplan’s project. Months before Polymarket predicted the President-elect, a debate between President Joe Biden and Trump created the pretext for a momentous shift in the Democratic ticket. Polymarket’s traders saw blood in the water, and a market betting that Biden would drop out before the election spiked following his disastrous performance against Trump. Even as Biden insisted he was in it for the long haul, Polymarket traders were relentlessly skeptical.

Eventually, the Polymarket consensus was validated.

“Polymarket called it. Before anywhere else,” Coplan said on X, calling the market prediction a “historical W.” “Trust the markets,” he added.

That early success attracted plenty of media attention (not all of it good) and that created a kind of ouroboros, with news coverage bringing in new users, and new users bolstering the nascent betting markets. Which was of course Coplan’s primary objective. He liked to showcase Polymarket’s iOS App Store rankings, highlighting its rank among established, mainstream apps such as YouTube and WhatsApp.

Shoutouts online from tech CEO Elon Musk and the integration of Polymarket’s data into Bloomberg’s Terminal, furthered Polymarket’s entrance to the mainstream. Polymarket got a boost in credibility when Nate Silver, the renowned statistician and journalist, joined Polymarket as an advisor in July.

“Politics aside, many of the people I looked up to from afar growing up have reached out to say they’re huge fans of Polymarket,” he said. “It’s a priceless feeling.”

By the time Election Day had come in November, more than 200,000 people a month were using Polymarket, per a Dune dashboard. As Americans went to the ballot box, the platform’s open interest—representing the total value of outstanding bets—totaled $463 million.

Polymarket’s U.S. general election market, which effectively became the platform’s namesake, ultimately generated over $3.6 billion in trading volume.

But money aside, the election tended to validate Polymarket’s ability to provide accurate information that goes above and beyond media spin, said Coplan.

“Every single person who follows politics learned firsthand that Polymarket is a more accurate way to follow politics than traditional news and the pollsters,” he said. “People will not forget that in years to come.”

What’s next?

While Polymarket has become a cultural phenomenon, the platform has faced regulatory scrutiny in the U.S., alongside its competitors. The Commodity Futures Trading Commission (CFTC), for example, brought an action against Polymarket for failing to register its services with the regulator in 2022. The platform officially became off-limits for U.S. citizens, while Polymarket reached a $1.4 million settlement with the CFTC.

Likewise, the CFTC tried to block political event contracts from another U.S.-based prediction platform, Kalshi, this year, which also focused on November’s elections.

The agency raised concerns about the potential of political event contracts to undermine the integrity of U.S. elections. But a federal court’s decision in September found that the CFTC’s proposed ban on Kalshi’s contracts exceeded its authority, setting the stage for new entrants in the prediction space such as the trading app Robinhood and the brokerage firm Interactive Brokers.

The CFTC meanwhile indicated that it plans on appealing the court’s Kalshi ruling, though the Trump Administration could well derail that action.

More troubling for Coplan was that shortly after Trump’s win, his New York apartment was raided by the FBI. At the time, a Polymarket spokesperson claimed the raid was an act of “political retribution” for predicting the outcome of the 2024 race.

Bloomberg News later reported, however, that the FBI’s raid was related to a Department of Justice investigation. The publication, citing a person familiar with the subject, said authorities were investigating Polymarket for allowing U.S. users to bet on the platform, despite the earlier CFTC settlement. The site is currently “geofenced,” meaning that users from U.S.-based IP addressees are automatically blocked from betting. However, that’s easy to circumvent via VPN services, which mask one’s IP address.

France’s national gaming regulator also started to look into Polymarket after a French trader won an estimated $47 million on $45 million in bets, which mostly centered on whether Trump would get reelected. Polymarket decided to block the betting market for French-based users.

As Polymarket navigates the post-election world, its relationship with regulators worldwide could prove key in building past this year’s surge in activity and new users. Still, Coplan said he enters 2025 optimistic, and he’s emboldened by his platform’s demonstrable success as a far better alternative to conventional polls.

“It’s moments like election night which set the precedent that Polymarket is more accurate than legacy alternatives,” Coplan said. “Trust must be earned, and it was.”

Certainly, the future looks brighter. With an incoming administration that’s likely to clarify regulations that pertain to crypto and prediction markets, Polymarket’s founder is upbeat.

“The incoming administration looked heavily at Polymarket forecasts throughout the election cycle, which is incredible news,” he said. “The first step is understanding why these markets are so valuable, which has been accomplished. The natural next step is to embrace it.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

2024-12-13 15:01:21